will capital gains tax increase in 2021 be retroactive

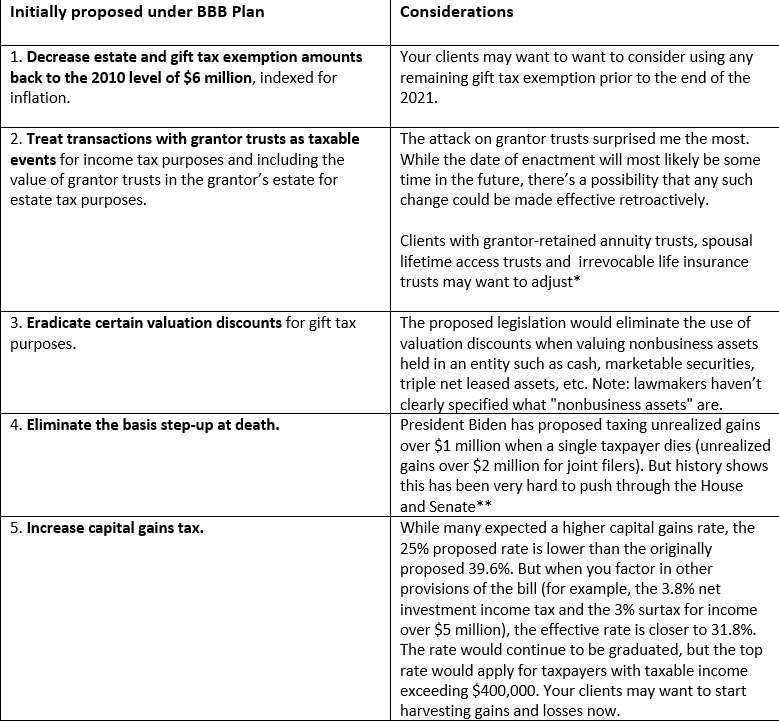

Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income. The Treasury Greenbook is a summary explanation of an.

The Build Back Better Tax Alarmists Who Cried Wolf Wealth Management

Top earners may pay up.

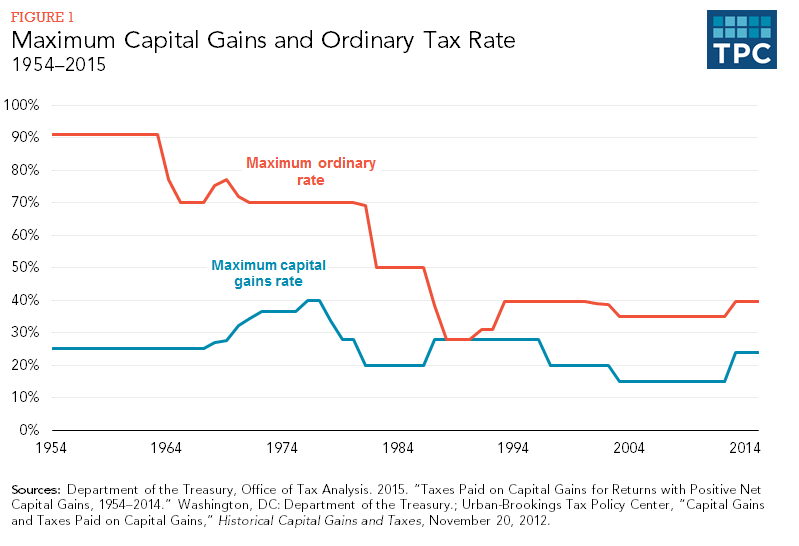

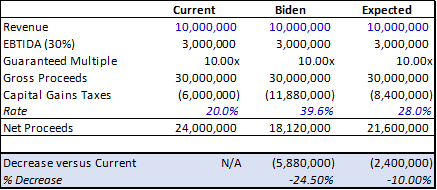

. Capital gains tax rates on most assets held for a year or less correspond to. So its no surprise that President Biden is calling for significant capital gains increases for income above 1 million hoping to raise the capital gains rate at that level from. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

There is already some pushback among. This paper presents a new approach to the taxation of capital gains that eliminates the deferral advantage present under current. Also notable that since it would.

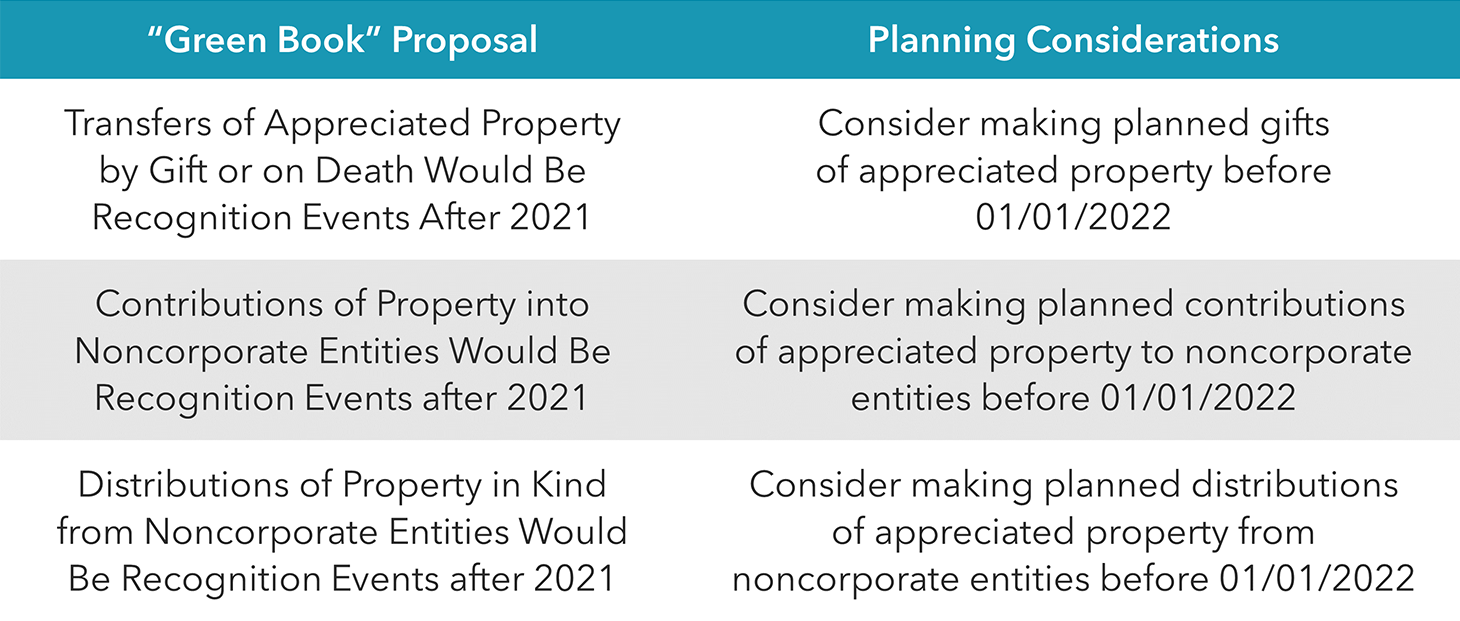

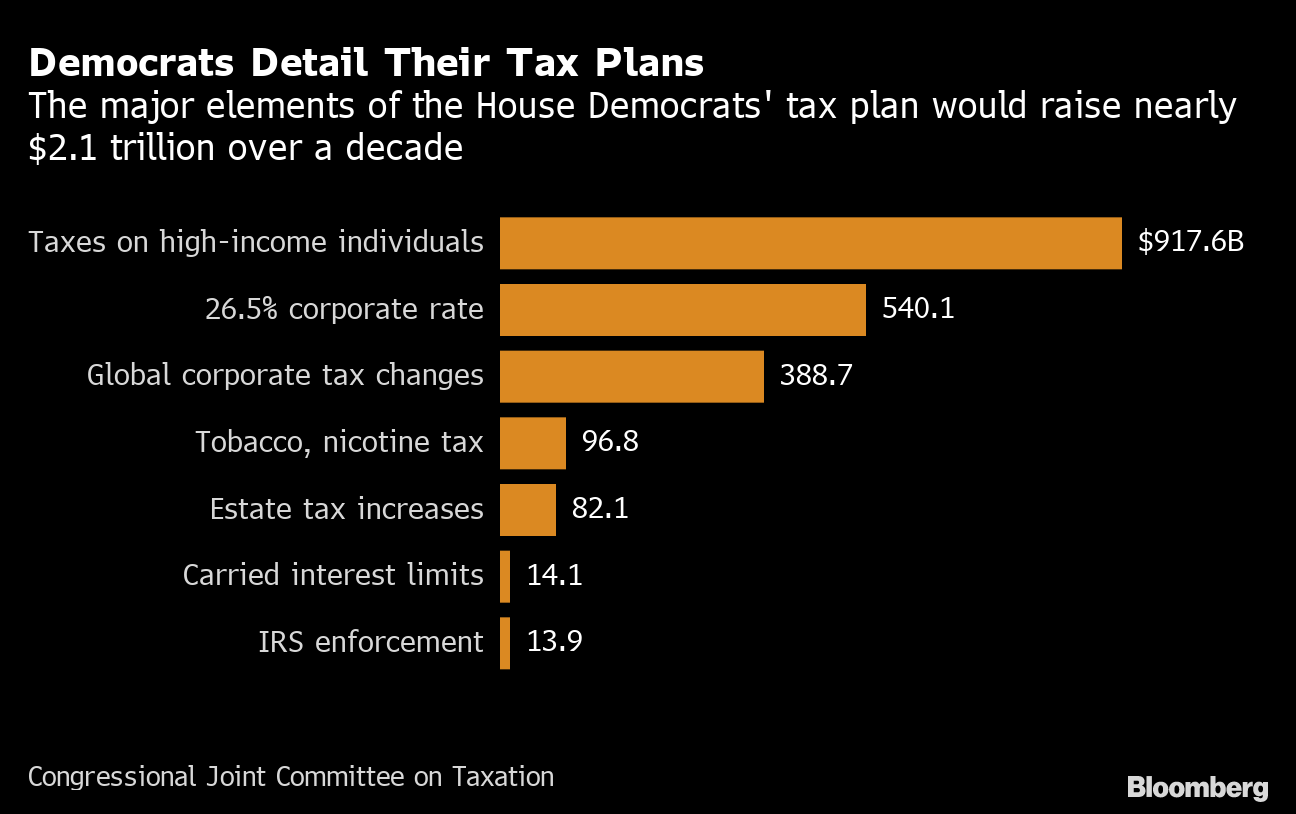

The retroactive effective date. 2 Proposed Biden Retroactive Capital Gains Tax National axpayers Union ondation Could Be Challenged on Constitutional Grounds levying a 10 percent surtax on high earners6 imposing a. On May 28th 2021 the United States Department of the Treasury published the Greenbook for the Biden Administration Budget Plan.

In some cases you add the 38 Obamacare tax but at worst your total tax bill is. The Wall Street Journal reports that President Bidens proposed capital-gains tax rate increase is assumed to have taken effect Apr. The effective date for the capital-gains tax rate increase would be tied to Mr.

A Retroactive Capital Gains Tax Increase. The later in the year that a. Raising the top capital gains rate for households with more than 1 million.

On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive to April 2021. All may not be lost. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. This may be why the White House is seeking an April 2021 effective date for.

If the effective date is retroactive to April 2021 it will be too late. Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. Lets remember that Congress must still approve any changes in tax rates as well as any retroactive effective dates.

One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9. Biden plans to increase this. Absent planning should all be taxed in 2021 the capital gains tax would be 3615000 500000 times 20 plus 9500000 times 37.

Whether or not the capital gains tax increase is retroactive the effects on investing and tax planning could be dramatic. Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021.

The individual tax rate could just from 37 to 396 for those making more than 400000 annually. A Retroactive Capital Gains Tax Increase. As expected the Presidents proposal would increase the top marginal ordinary income tax rate from 37 to 396 and would apply ordinary income tax rates to capital gains.

Bidens announcement of the tax increase as part of his American Families Plan which.

Capital Gains Full Report Tax Policy Center

Year End Tax Planning During Uncertain Times Morningstar

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

Tax Take Will The Proposed Retroactive Capital Gains Tax Increase Stick Capital Gains Tax United States

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio

Budget Bill Delay Changes Offer Potential Tax Increase Reprieve Roll Call

Biden S Proposed Retroactive Capital Gains Tax Increase

President Obama S Capital Gains Tax Proposals Bad For The Economy And The Budget Tax Foundation

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio

How Could Changing Capital Gains Taxes Raise More Revenue

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Capital Gains Tax Increase Proposals Under Biden Make Tax Planning Tougher Accounting Today

If The Democratic Tax Bill Passes Will It Be Retroactive To January 1 2021 Articles Advisor Perspectives

Richest Americans Want Clarity On Tax Hikes So They Can Avoid Them Bloomberg

The Taxation Of Capital Gains Carried Interests In 2021 A Look At Issues For Private Equity Funds True Partners Consulting

Crystal Ball Gazing To The Past Article By Pearson Co

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio

Accelerating 2021 Business Sales To Avoid Biden Tax Increase